Vestberry

Vestberry is a portfolio intelligence solution designed for venture capital funds to maximize portfolio value through actionable insights, comprehensive portfolio monitoring, and automated data management.

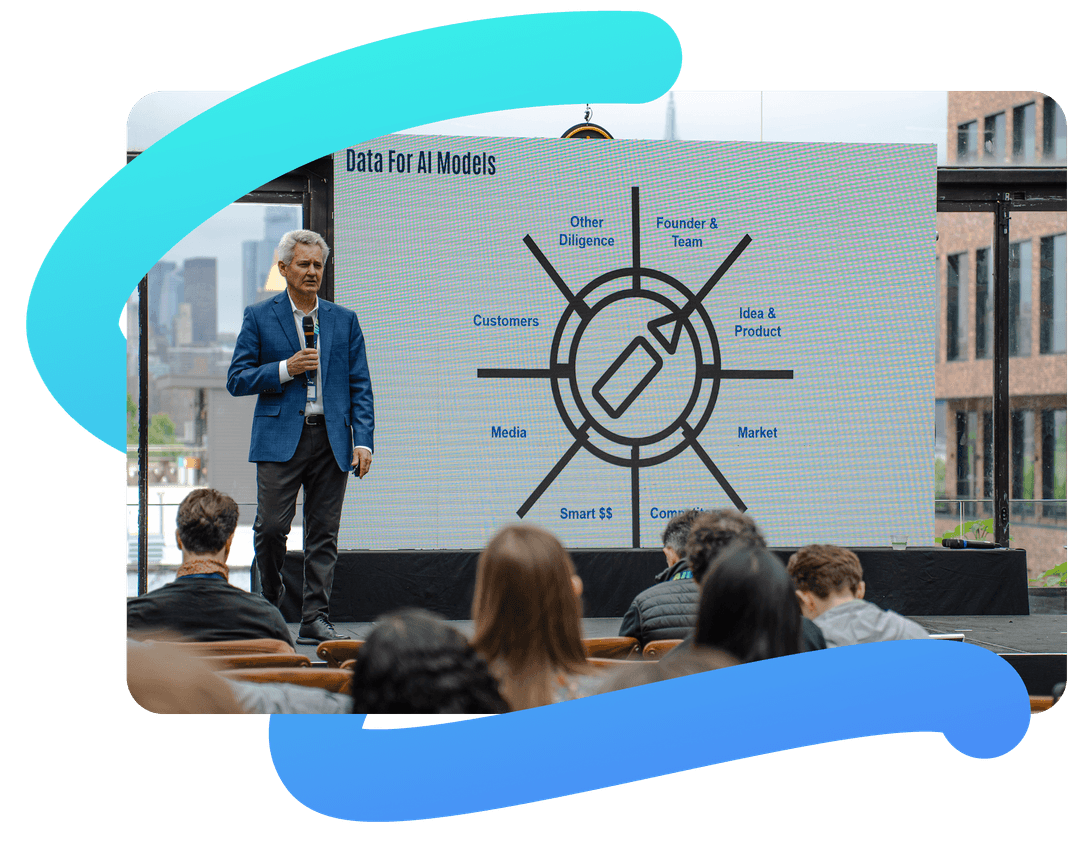

At Venture Intelligence Day in New York, Fred Campbell, Managing Partner at TRAC, shared results from what may be one of the boldest experiments in venture capital: letting AI make every single investment decision. Since TRAC’s launch in 2020, the firm has invested in more than 100 companies without a single decision coming directly from a human partner. The outcomes offer a rare glimpse into what AI can and can’t do for venture investing.

In over four years, TRAC has deployed $81 million across 106 investments. According to Campbell, 70% of portfolio companies have raised at least one follow-on round, while only 8.5% of capital has been lost, placing the fund among the top 2–3% of VCs on that measure. Most strikingly, companies that clear TRAC’s algorithms have a one-in-six chance of becoming unicorns at seed stage, compared with about one-in-nine odds for even the best-performing human “super forecasters.”

For an industry where most bets don’t pay off, these results suggest that AI can rival some of the best human investors at spotting winners early.

Venture investing is often described as pattern recognition: markets taking off, teams showing early resilience and technologies breaking through. The challenge is that only about 1% of investors consistently forecast outcomes well. For the rest, gut feel looks more like guesswork.

AI changes the equation. It can surface subtle correlations in enormous datasets (whether from competitor activity, market timing or media momentum). Campbell even noted that tech journalists, by collectively covering trends early, sometimes outperform investors in predicting unicorns. Algorithms bring that same edge, but at scale.

Still, algorithms are not a crystal ball. AI cannot evaluate founder charisma, grit, or trust dynamics, all of them critical to early-stage bets. Nor can it imagine entirely new categories that haven’t yet appeared in the data. Those remain firmly in the human domain.

As such, the strongest model is not AI or humans in isolation, but in partnership. Algorithms accelerate due diligence, reduce bias and highlight opportunities. Humans provide creativity, conviction and relationships that make deals happen.

For most funds, going all-in on AI just isn’t realistic. Data is usually scattered across spreadsheets and notes, in different systems. Qualitative inputs are messy, and even if the tech is ready, building trust across the whole team takes time. On top of that, a full AI rollout can be costly. That’s why firms like TRAC, built from the ground up with AI, have a head start. But it doesn’t mean others can’t catch up.

At the end of the day, whether you’re leaning into AI or not, good decision-making starts with good tracking. If your data isn’t reliable or accessible, no algorithm or partner’s gut feel can help. This is where Vestberry comes in.

Vestberry gives funds the foundation they need to be truly data-driven:

The future of VC doesn’t have to mean going AI-only. But it will be data-driven. And the funds that get their tracking right today will be the ones positioned to compete tomorrow.

TRAC’s results show that AI can sharpen investment outcomes, but they also highlight what remains uniquely human. The next decade of VC will belong to firms that combine machine intelligence with human judgment to make better, faster, and fairer decisions.