Vestberry

Vestberry is a portfolio intelligence solution designed for venture capital funds to maximize portfolio value through actionable insights, comprehensive portfolio monitoring, and automated data management.

In the first half of this year, Vestberry welcomed a diverse group of VC firms to its platform, from early-stage venture capital funds to some of the largest VC fund managers. While their geographic locations or portfolio sizes vary, the underlying challenges they face are strikingly similar, between manual data workflows, fragmented systems, and increasing pressure to deliver transparency to stakeholders.

This article outlines the key patterns we saw across new clients in H1, the pain points they aimed to solve, and what their decisions tell us about the direction of fund management in 2025 and beyond.

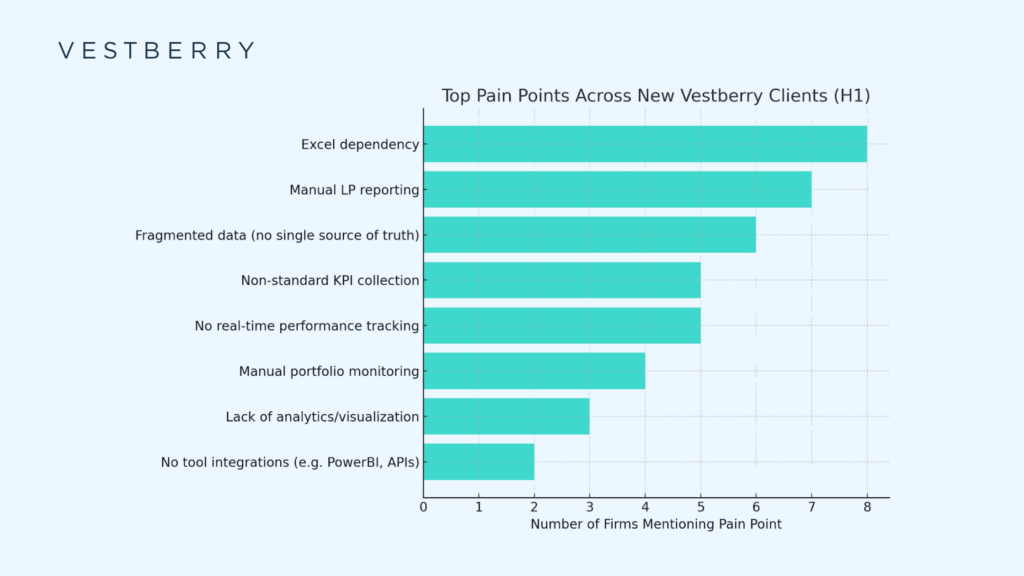

The same phrases appear again and again. The most commonly cited challenges included:

One of our VC clients from Asia described their situation simply: “Currently everything is in excel.” Oxo Technologies echoed this: “Manual reporting processes with portfolio companies (excel based).”

Nine of the ten firms mentioned Excel explicitly. This was evidence of an industry-wide dependency that had quietly become a liability.

The deeper issue wasn’t the software itself but what it represented. As another firm put it, “Portfolio company related data is usually not stored at the same place and not being up-to-date.” Critical investment information was scattered across email threads, shared drives, and individual laptops.

Ask any fund manager about their least favorite time of year, and many will mention the weeks before LP reports are due. The pattern was identical across firms: frantic emails to portfolio companies requesting updates, manual data entry into spreadsheets, formatting reports, double-checking calculations, while hoping nothing was missed.

One of the VC firms described it as “time spent on collecting data and ensuring it is correct, as well as building the report every quarter.” Another European VC Firm had the same experience: “Time spent retrieving the data from the portfolio companies. Manual calculations and building of the report forms.”

This wasn’t just inefficient. It was preventing firms from doing their actual job. Instead of analyzing portfolio performance and identifying opportunities, teams were consumed with data collection and formatting. Instead of developing investment insights, they were building spreadsheets.

Three firms used identical language in describing their goal: establishing “a single source of truth both at fund and portfolio company level.”

The requirements were specific and ambitious. One of the VC funds wanted “fully automated portfolio monitoring, from collection of data, to streamlined data, to consolidation of data into quarterly reports.” One CVC from the USA needed “useful analytics and portfolio insights.” EnBW New Ventures required “connectivity with PowerBI and Excel.”

Why Vestberry Won

These expectations were more than to replace Excel with a slightly better spreadsheet. Here’s where Vestberry makes the difference:

First was comprehensiveness. Unlike point solutions that solved individual problems, Vestberry addressed the interconnected nature of fund operations. As one of our clients shared on G2, an independent third party tool for software reviews mentioned:

Second was automation capability. Every firm emphasized this requirement. Purple Ventures wanted to solve “lack of source of truth” and “kpi collection” simultaneously through automated workflows.

Third was collaborative design. Modern fund management involves multiple team members, portfolio company representatives and external advisors. Oxo Technologies emphasized managing data “in a collaborative manner.” The platform needed to support team-based workflows rather than individual spreadsheet ownership.

Fourth was integration flexibility. Sophisticated firms had existing technology investments they wanted to preserve. For example, EnBW New Ventures needed PowerBI connectivity. Vestberry’s platform approach accommodated these requirements rather than requiring complete replacement.

Before & After: Portfolio Management Transformation

Before Vestberry

⛔ Portfolio companies email Excel sheets

⛔ Internal teams validate, clean, and merge data

⛔ LP report takes weeks, with high risk of error

With Vestberry

✅ Portfolio companies submit KPIs via structured forms

✅ Data syncs to dashboards automatically

✅ LP reports are generated in minutes, not weeks

What this means for VC funds

Manual processes aren’t just becoming less efficient, they’re becoming competitively disadvantageous. Funds are under growing pressure to act faster, justify decisions and operate with transparency. Firms using modern portfolio management platforms can produce better LP reports, make faster investment decisions, and identify portfolio needs earlier. They can spend more time on value creation and less time on data collection. These advantages compound over time.

The firms that made the switch from manual processes to a mature solution didn’t do so because they loved technology. They did so because they loved investing, and the Vestberry solution enabled them to focus on what they do best. They traded data collection for data analysis, manual reporting for strategic thinking and operational complexity for competitive advantage.

If your fund is still reliant on spreadsheets, if LP reporting takes up more time than it should, or if your investment team lacks real-time visibility, know that you’re not alone.

Firms like the ones above made the switch to future-proof their fund operations through clear workflows. Vestberry is becoming the trusted infrastructure for VC firms that want to manage their portfolio in the value created with confidence.

Do you want to see if Vestberry is for you?

Whether you’re managing a small team or scaling across multiple funds, Vestberry can help you operate with clarity, speed, and control.